Annuity tax calculator

We have the SARS tax rates tables. Report income tax withholding from pensions annuities and governmental Internal Revenue Code section 457 b plans on Form 945 Annual Return of Withheld Federal Income Tax.

Retirement Annuity Calculators For Advanced Income Growth Planning

An annuity running over 20 years with a starting principal of 25000000 and growth rate of 8 would pay approximately 209110 per.

. Earnings are taxable as ordinary income when distributed. An annuity can provide you with income that is guaranteed for as long as you live. Annuity Calculator - Calculate Annuity Payments.

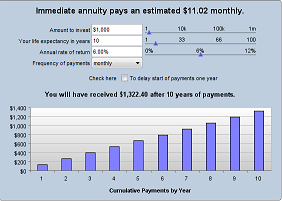

Annuity Tax Advantages Calculator. Your life expectancy is 10 years at retirement. Next we take this annual income figure of 6600 and multiply it by the IRS life expectancy multiple of 20 and get 132000.

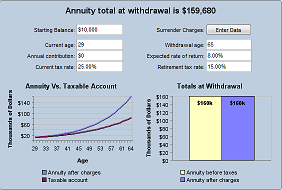

Use this calculator to compare the tax advantages of saving in an annuity versus an account where the interest is taxed each year such as a CD or brokerage account. Take the next step. With this calculator you can find several things.

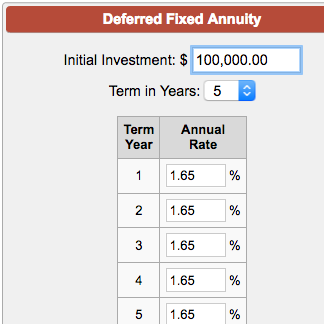

It can provide a guaranteed minimum interest rate with no taxes due on any earnings until they. Find out how much you can save with a tax-deferred annuity. An annuity is an investment that provides a series of payments in exchange for an initial lump sum.

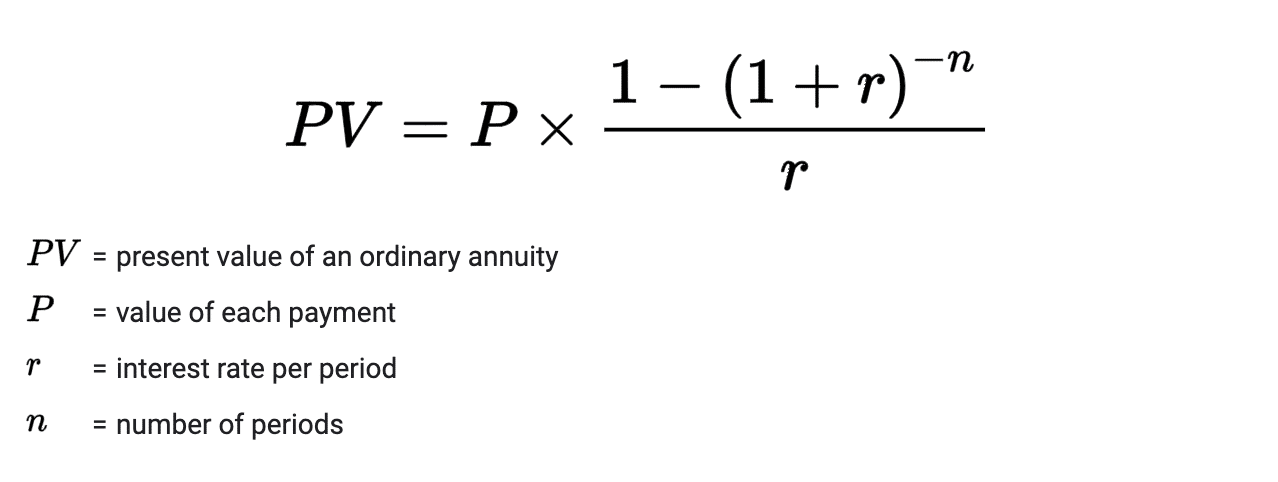

T Number of years of payments. This analysis will help to compare the accumulation values and after-tax withdrawals of an investment being subject to income tax each year versus deferring the tax until withdrawals. A Fixed Annuity can provide a very secure tax-deferred investment.

R Annual interest rate. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. ANNUITY PRE-TAX INCOME ANNUITY AFTER-TAX INCOME.

Annual payments of 4000 10 of your original investment is non. The payment that would deplete the fund. Variable annuities involve investment risks and may lose value.

These retirement savings vehicles do provide some tax benefits by letting earnings grow tax. When you inherit an annuity you assume what is referred to as the owners basis which means you own the amount of already-taxed money in the account. N Number of payments per year.

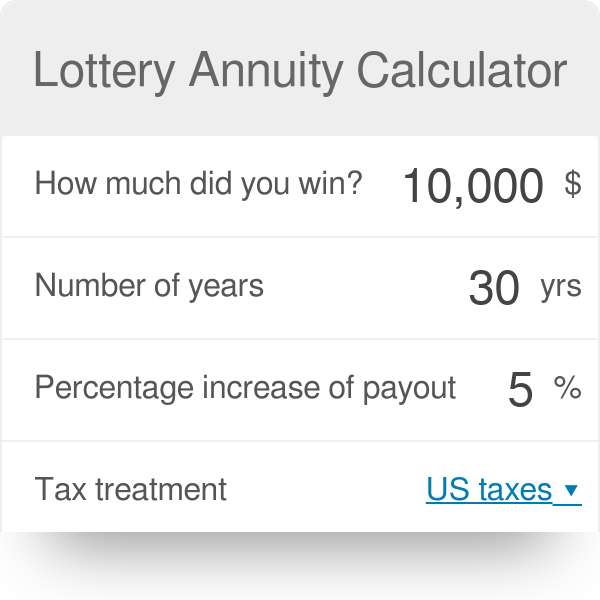

Includes projected Federal annuity and Thrift Savings Plan benefits to help you quickly identify approximately how much you need to save to fund a comfortable retirement. Annuity-based lottery payouts work the same way as common immediate annuitiesMore specifically lottery annuity payments are a form of structured settlement where. Annuities are long-term tax-deferred vehicles designed for retirement.

Interest rates will vary depending on the type of annuity and the provider. You have an annuity purchased for 40000 with after-tax money. So the IRS assumes that a 65 year old will.

And you have the same amount of. This annuity calculator will estimate how much income you can get and compare it to income from a GIC or RRIF.

Annuity Calculator

The Best Annuity Calculator 17 Retirement Planning Tools

Annuity Taxation How Various Annuities Are Taxed

How To Calculate Annuity Payments 8 Steps With Pictures

Lottery Annuity Calculator

How To Measure Your Annuity Due

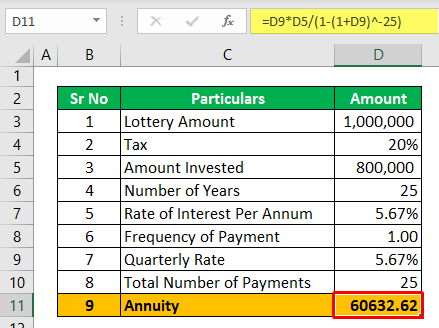

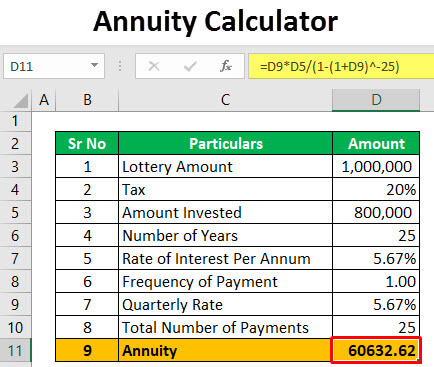

Annuity Calculator Examples To Calculate Annuity

Best Lottery Tax Calculator Mega Millions Powerball Lotto Tax

Calculating Pv Of Annuity In Excel

Lotto Annuity Calculator Discount 59 Off Www Ingeniovirtual Com

Annuity Exclusion Ratio What It Is And How It Works

Retirement Withdrawal Calculator For Excel

Lottery Tax Calculator

Annuity Calculator Examples To Calculate Annuity

Annuity Taxation How Various Annuities Are Taxed

Retirement Annuity Calculators For Advanced Income Growth Planning

Deferred Fixed Annuity Calculator